Understanding the Current State of the Housing Market in May 2023

Introduction: As a real estate agent, I want to provide you with some insights into the current housing market. In May 2023, the housing market is experiencing rising mortgage rates and home prices that are affecting homebuyers’ budgets.

Average Monthly Mortgage Payment: According to a new study from LendingTree, the average monthly home loan payment as of May 2023 is $2,317. Buyers are taking out larger mortgages to afford the rising costs of homes, with the average size of a LendingTree mortgage in 2022 being $333,342.

Where Borrowers are Paying the Most, Least: Borrowers in every state should expect to spend at least $1,700 a month on mortgage payments, according to the LendingTree study. However, in Hawaii, where mortgage payments are the highest in the country, the average is $3,696. In California, the average monthly mortgage payment is $3,000, and households are spending 34% of their average monthly income on housing.

Importance of Budgeting: While a mortgage payment is a significant monthly expense for homeowners, they also face other costs related to homeownership that they should budget for. According to Jacob Channel, LendingTree’s senior economist, “Utilities and regular repair and maintenance costs are also important for people to keep on top of.” Rising property taxes are taking a sizable chunk of household budgets as well. With that in mind, buyers shouldn’t craft a housing budget based exclusively on their mortgage payment.

Household Income: In Hawaii and California, households are spending 40% and 34%, respectively, of their average monthly income on housing. Most financial experts advise households not to spend more than 30% of their monthly income on housing. Therefore, it’s crucial to budget accordingly and consider all of the expenses associated with homeownership before purchasing a home.

As a real estate agent, I can help you navigate the current housing market and find a home that fits your budget and lifestyle. Let’s work together to find your dream home while staying within your budget.

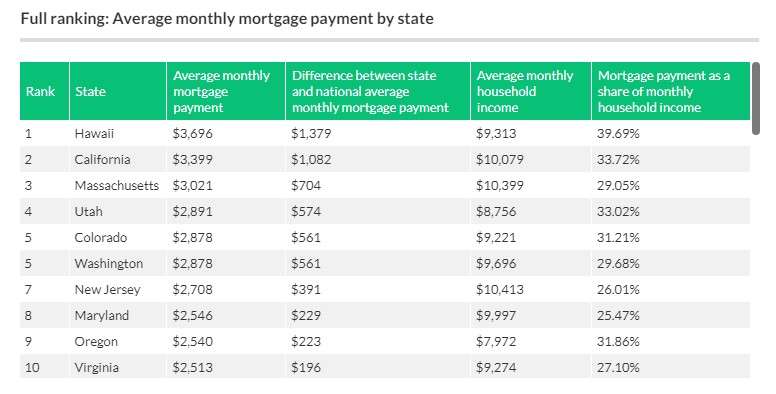

A State-by-State Comparison of Mortgage Payments and Household Income

Owning a home is one of the biggest investments a person can make in their lifetime. However, it can be a costly venture, especially when it comes to paying for a mortgage. Mortgage payments can vary significantly from state to state, and so can the average monthly household income. In this article, we will compare the average monthly mortgage payments and average monthly household income in all 50 states in the United States.

Top 5 States with the Highest Monthly Mortgage Payments

According to the data, Hawaii tops the list of states with the highest average monthly mortgage payments, with an average of $3,696 per month. California comes in second, with an average monthly mortgage payment of $3,399. Massachusetts, Utah, and Colorado complete the top five, with average monthly mortgage payments of $3,021, $2,891, and $2,878, respectively.

Top 5 States with the Lowest Monthly Mortgage Payments

On the other end of the spectrum, West Virginia has the lowest average monthly mortgage payment, with an average of $1,700 per month. Kentucky, Michigan, Mississippi, and Ohio round out the bottom five, with average monthly mortgage payments of $1,711, $1,742, $1,757, and $1,759, respectively.

States with the Highest and Lowest Mortgage Payments as a Share of Monthly Household Income

Paying for a mortgage can take up a significant portion of a household’s income, leaving little room for other expenses. The data shows that Hawaii has the highest mortgage payment as a share of monthly household income, with an average of 39.69%. This means that, on average, Hawaiians spend almost 40% of their monthly household income on mortgage payments.

West Virginia, on the other hand, has the lowest mortgage payment as a share of monthly household income, with an average of 28.22%. This means that West Virginians spend just over a quarter of their monthly household income on mortgage payments.

The States with the Greatest and Smallest Differences Between State and National Average Monthly Mortgage Payments

While some states have high mortgage payments, they may also have high average monthly household incomes that make it easier to afford. The data shows that Hawaii has the largest difference between the state and national average monthly mortgage payment, with an average difference of $1,379. This means that Hawaiians pay $1,379 more per month than the national average for mortgage payments.

In contrast, West Virginia has the smallest difference between the state and national average monthly mortgage payment, with an average difference of $617. This means that West Virginians pay $617 less per month than the national average for mortgage payments.

Cost of Owning a Home

The cost of owning a home can vary significantly from state to state, as shown by the data. While some states have high mortgage payments, they may also have high average monthly household incomes that make it easier to afford. On the other hand, some states may have lower mortgage payments, but they may also have lower average monthly household incomes. It’s essential to take both factors into account when considering purchasing a home and to choose a home that fits within one’s budget.

Leave A Comment

You must be logged in to post a comment.