I have been in real estate in one form or another for well over 22 years. I have seen all types of markets and all types of things that were going to “kill the market” or “change real estate forever”. What I realized years ago is just like everything in the world, real estate has its own drama. That drama is alive and well today.

How Has the Market Changed?

The news is talking about how bad it is and how the sky is falling. Well, when I woke up this morning the sky was exactly where it was when I went to bed last night. Things are shifting but change isn’t always bad. Sellers were starting to get a little too much control there. Contracts in most states (including Colorado and Florida) are written in the buyer’s favor. The buyer is supposed to have a lot of outs if the home isn’t up to the way it was presented by the seller or listing agent. For a while, buyers were pretty much giving up any ability to terminate for any reason. This was putting a large earnest money amount in jeopardy on almost every transaction. In my market, the average earnest money deposit is around $20-$35K depending on price point.

How Have Offers Changed in the Recent Market?

Basically, buyers were making offers waiving almost every single contingency effectively making earnest money “hard” as soon as the offer was made. Home didn’t appraise? Sorry buyer, close, bring the extra 50k in cash to close or give us your earnest money. Home sliding down the side of the mountain? Sorry buyer, close or give us your earnest money. You can see how this becomes a problem. How buyers got upset at how things are going? The worst possible scenario for negotiations is being in the weakest position. Buyers were always in a weak position because there were 15 other buyers for that home if these buyers terminated.

Interest Rates Aren’t Really That Bad

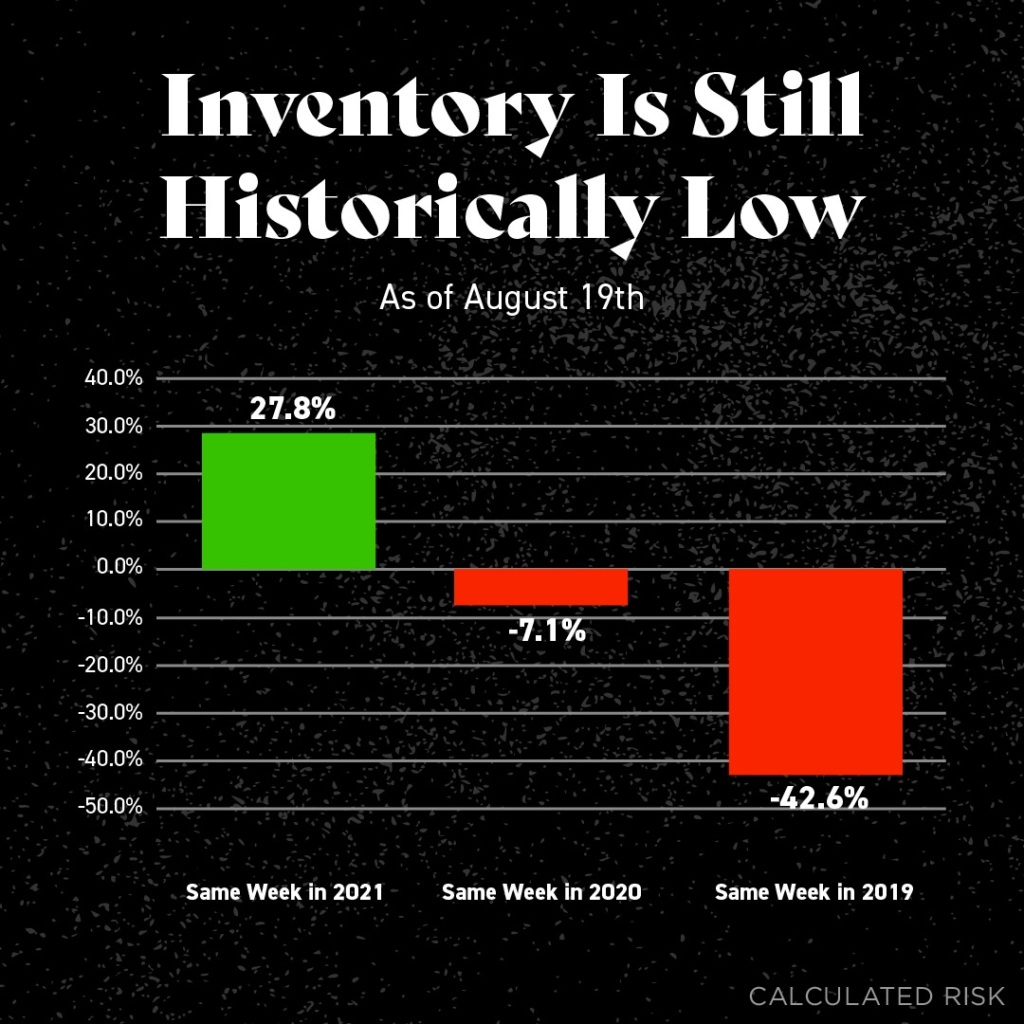

That was then, this is now. Currently, interest rates are about 6% and inventory is lower than it was during the craziest part of the market. This is like a market we have never seen (at least not in my career). We came off historically low rates (for an extremely long time) into talks of a recession. Just to put things into perspective, my parents bought their home in the 70s at 13% interest. It is true that in today’s market a 1% increase in rates adds about 10% to the buyer’s payment. That is a large increase but still more expensive than the people that bought when prices were higher and rates low. It is a perfect example of people pricing themselves out of something by trying to save a few bucks.

Denver Foothills and Denver Mountian Real Estate Markets Still Strong

The Denver Foothills and Denver Mountains will always be a place people want to live. A place of higher than average home values and higher cost of living. Why is that? Because everyone wants to live there. The supply is low, demand is high and interest rates are a variable that will always be there but not a damn thing can be done about it.

Too Much Data not Enough Answers

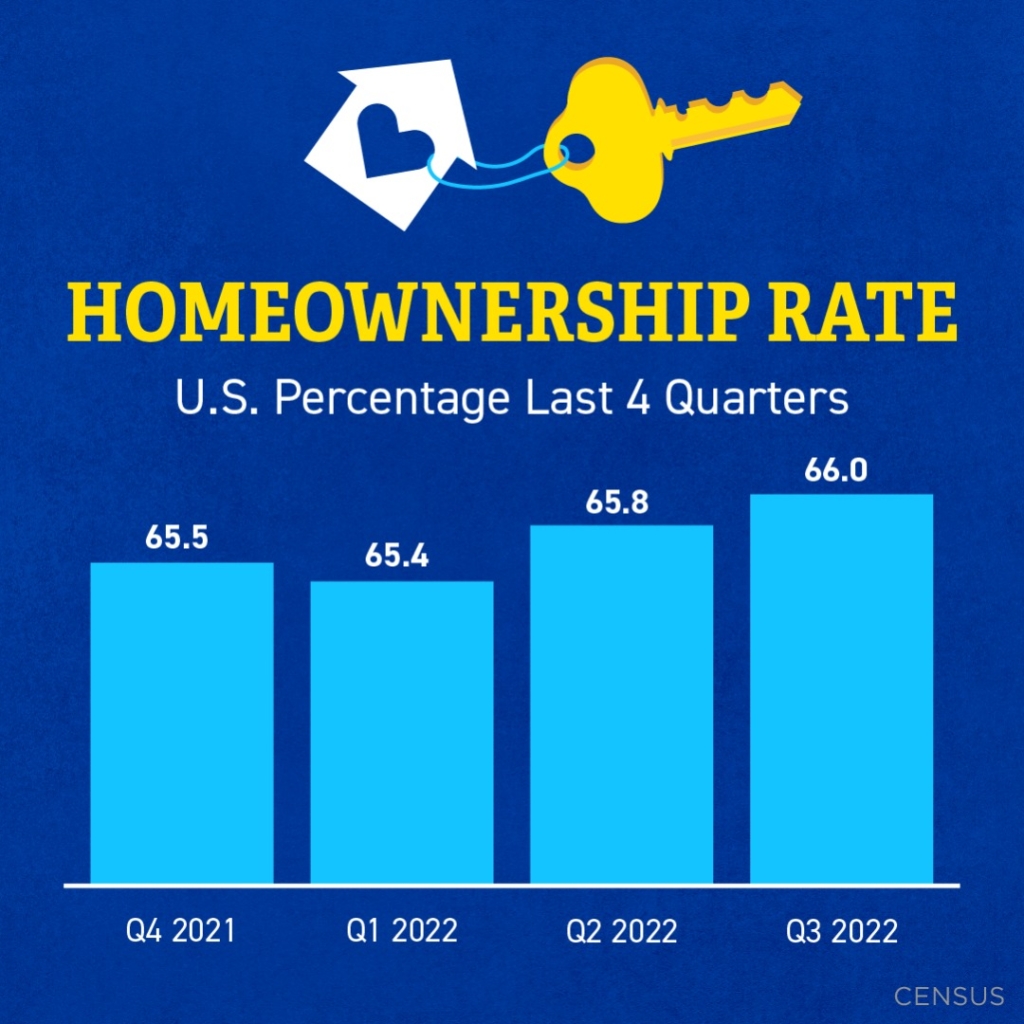

It is a hard thing to wrap your head around these days. There is so much conflicting information and data out there it is hard to decipher. Your home is most likely your biggest (or one of them) investment. It is hard to not look at it that way. But it is a long-term investment. This isn’t HGTV. You aren’t going to always make a killing on your primary residence. It serves a function as well as an investment. If you get a piece of mind, a place to live for you (and maybe your family) and live in a beautiful place, is that not an investment too? It isn’t just monetary. Some other things are just as important. In other words, you may not find a home that will give you a 200% return in 3 years but you still might be making a sound investment making 6-8% a year and have a roof over your head and great quality of life.

So Should I Sell My Home in This Market?

The Short answer is absolutely. Unless you bought in July of last year you most likely have a decent amount of equity. You also most likely missed the boat of getting everything you want in the deal. You will need to treat it like the old days. You won’t be getting a 90 day free lease back or the ability to not worry about appraisal but you most likely get market value for your home. And that is pretty much all you can ask for these days.

Should I Buy a New Home in This Market?

Another absolutely. Again, thinking you are good enough at picking the market and buying at the lowest price is unrealistic and will end up costing you big time in the long run. You will never time the market perfectly. If you could you wouldn’t have your current job. You would be a real estate investor making millions.

Leave A Comment

You must be logged in to post a comment.