Honestly I don’t think I am at all upset about this. It will actually help my 2 markets (Colorado and Florida) with our extremely low inventory.

Airbnb, the renowned platform that has revolutionized the way people travel by allowing homeowners to rent out their properties to travelers, is currently facing a potential revenue crisis. This crisis, according to a real estate expert, could lead to a housing market crash in certain cities, reminiscent of the 2008 subprime crisis.

Airbnb, the globally recognized platform that has transformed the travel industry by enabling homeowners to lease their properties to vacationers, is presently grappling with a potential revenue crisis. According to a real estate specialist, this crisis could precipitate a housing market crash in specific cities, echoing the 2008 subprime crisis.

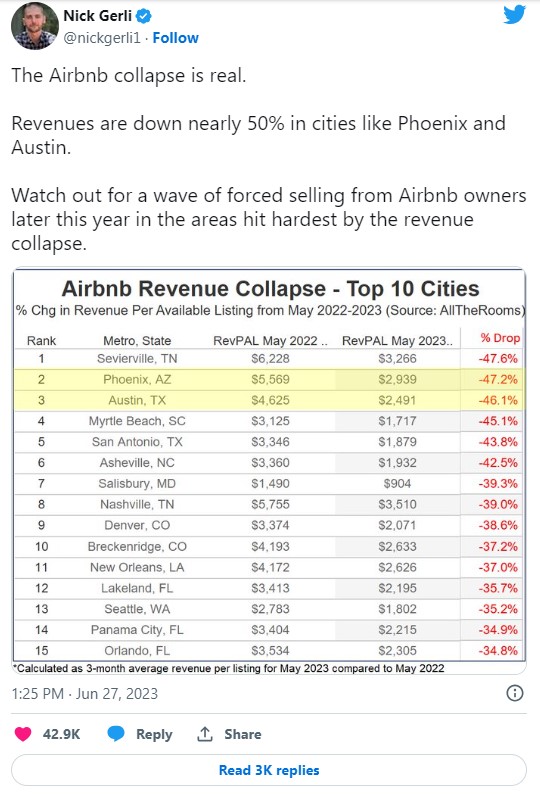

Headquartered in San Francisco, Airbnb has reported a nearly 50 percent revenue decline in cities such as Phoenix, Arizona, and Austin, Texas. This substantial decrease suggests an impending crisis. The information is derived from recent data provided by AllTheRooms, which compared Airbnb’s profits in May 2022 and May 2023.

Airbnb’s innovative business model has been a disruptor in the hospitality sector. By creating a platform for homeowners to lease their properties, Airbnb has broadened the choices for travelers beyond conventional hotels. However, the current scenario indicates that the company is confronting a significant challenge.

A single-story property at the Allen Stone Pop Up And Performance At Airbnb Park During SXSW on March 15, 2014, in Austin, Texas, exemplifies Airbnb’s revenue decline since mid-2022. The company, once a beacon of the sharing economy, is now experiencing a downturn in its fortunes.

Nick Gerli, CEO of Reventure Consulting, a firm that offers advice to homebuyers and real estate investors, has been outspoken about the “real” Airbnb collapse. He disseminated the company’s revenue data on social media, highlighting the gravity of the situation.

“Cities like Phoenix and Austin have seen revenues drop nearly 50%,” Gerli wrote. He suggested that this drastic revenue drop might compel homeowners who had listed their properties on Airbnb to sell, potentially causing a housing market crash in some cities akin to the 2008 crisis.

The potential ramifications of such a situation could be extensive. Homeowners who had depended on the income from Airbnb rentals might find themselves unable to meet their mortgage payments. This could lead to a surge in forced sales, particularly in areas most affected by the revenue decline.

Other cities that have experienced significant revenue drops this year compared to 2022 include Sevierville, Tennessee, with a 47.6 percent drop; San Antonio, Texas, with a 43.8 percent drop; Nashville, Tennessee, with a 39 percent drop; Denver, Colorado, with a 38.6 percent drop; New Orleans, Louisiana, with a 37 percent drop; and Seattle, Washington, with a 35.2 percent drop. This data represents a three-month average revenue per listing for May 2023, compared to May 2022.

The situation is not confined to a few cities. The trend of declining revenues is widespread, impacting various parts of the country. This could have a domino effect on the housing market, particularly in areas where Airbnb rentals constitute a significant portion of the housing stock.

Gerli also expressed concern about the potential impact of Airbnb’s likely downfall on the U.S. housing market, given the large number of Airbnb listings compared to homes listed for sale. “AllTheRooms data shows 1 million Airbnb/VRBO rentals in the U.S., compared to only 570k homes for sale. This could lead to a significant drop in home prices if struggling Airbnb owners decide to sell,” Gerli wrote.

In Phoenix, for instance, Gerli noted that the estimated 18,000 short-term rentals are more than double the number of homes listed for sale (estimated at 8,000). “Combine the large Airbnb supply with revenues down 50%, and you have a recipe for massive forced selling,” he tweeted.

The situation in Sevierville, the eastern Tennessee city that topped Airbnb’s revenue loss list, is even more alarming. Airbnb listings are 10 times the number of homes listed for sale. “”Yikes,” Gerli commented. This imbalance between supply and demand could lead to a significant drop in property prices, affecting not just Airbnb hosts but all homeowners in the area.

Regions where Airbnb’s revenue losses have approached 50 percent—eastern Tennessee, central Texas, the Pacific Northwest, and the Mountain region—are likely to see less experienced Airbnb owners forced to sell. These are areas where the Airbnb model had seen significant growth, with many homeowners jumping on the bandwagon to take advantage of the booming short-term rental market. However, the current situation could lead to a reversal of this trend.

“New Airbnb owners who bought with a mortgage in the last 1-2 years are likely in trouble,” Gerli wrote.

“They entered at a high price point, have high monthly payments, and little room for error. They could be among the first to sell later in 2023 when the season ends.”

This situation could lead to a significant shift in the housing market. Homeowners who had bought properties with the intention of renting them out on Airbnb could find themselves unable to cover their costs due to the drop in rental income. This could force them to sell their properties, leading to an increase in the supply of homes on the market.

On the other hand, more experienced Airbnb owners may be less inclined to sell despite the profit loss, according to Gerli. These owners likely purchased their properties at lower mortgage rates and are under less financial pressure. They may be able to weather the storm and hold onto their properties until the market recovers.

However, the overall impact on the housing market could be significant. The increase in the supply of homes on the market could lead to a drop in prices, affecting all homeowners, not just those who had listed their properties on Airbnb.

Gerli anticipated an Airbnb crash, attributing it to a decrease in post-pandemic travel demand following a significant increase in Airbnb supply. “The pandemic is over. Fewer people are working from home or vacationing in states like Montana, Texas, and Tennessee,” he explained. “So demand is significantly down, just as Airbnb supply has dramatically increased. This leads to a crash.”

The end of the pandemic has led to a change in people’s travel and work habits. With more people returning to the office and fewer people taking vacations, the demand for short-term rentals has decreased. At the same time, the supply of Airbnb rentals has increased, leading to an oversupply in the market.

However, Gerli believes an Airbnb crash could ultimately help rebalance the real estate market and provide new opportunities for homebuyers and investors in 2023 and 2024.

An increase in Airbnb sales would boost the number of homes available for sale or rent, driving down prices and rents. This could enable prospective homebuyers who had been priced out of the market to re-enter. A decrease in inventory could also eventually stabilize Airbnb, creating “fresh opportunities for aspiring Airbnb investors,” according to Gerli.

While the current situation is challenging for Airbnb and its hosts, it could lead to a rebalancing of the housing market. The increase in the supply of homes could make homeownership more accessible for many people who had been priced out of the market. At the same time, it could provide new opportunities for investors looking to enter the short-term rental market. However, the situation also serves as a reminder of the risks associated with relying on a single income source, such as Airbnb rentals.

Leave A Comment

You must be logged in to post a comment.