Buying a home is a significant financial decision and can be a complex process, but it can also be an exciting journey. Here’s a general overview of the steps involved:

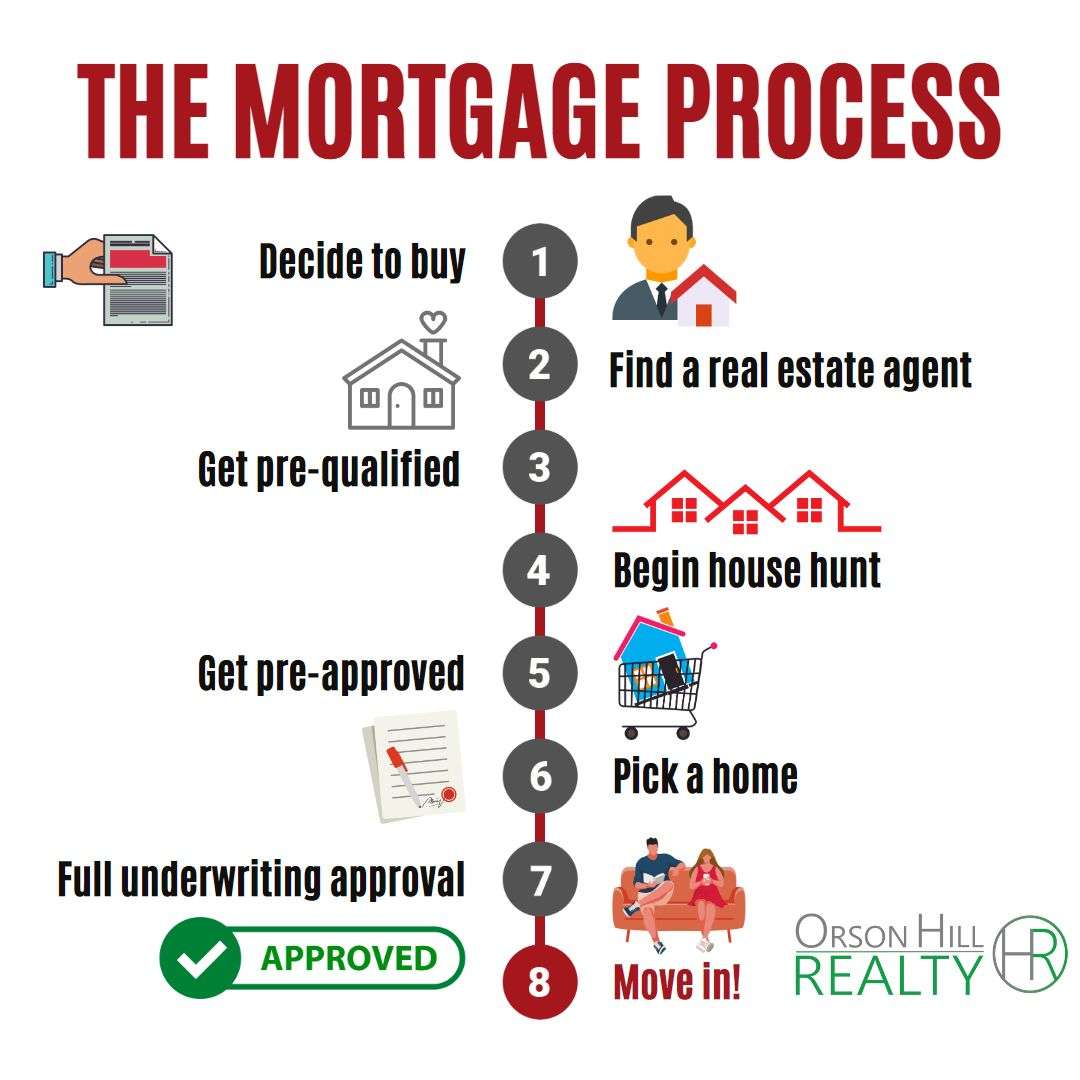

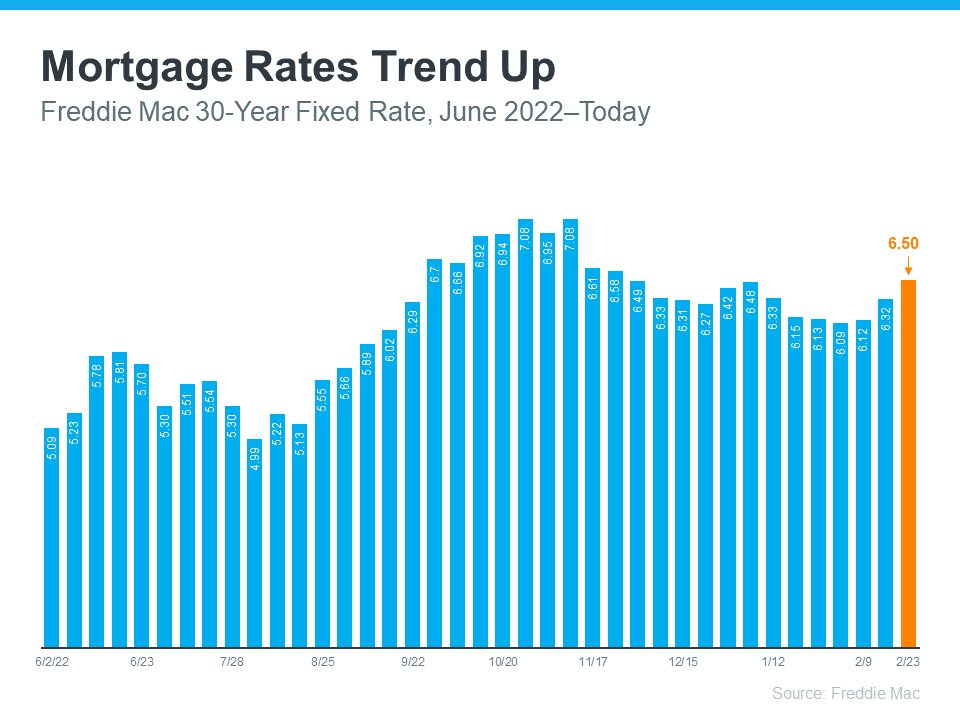

Determine Your Budget: Before you start looking for a home, it’s important to understand how much you can afford. This typically involves reviewing your income, savings, and current monthly expenses. You may also want to get pre-approved for a mortgage, which can give you a better idea of your budget and make you more attractive to sellers.

Find a Real Estate Agent: A real estate agent can guide you through the process of buying a home, from finding listings that match your preferences and budget, to negotiating the price and closing the deal. They have expert knowledge of the local market and can provide valuable advice.

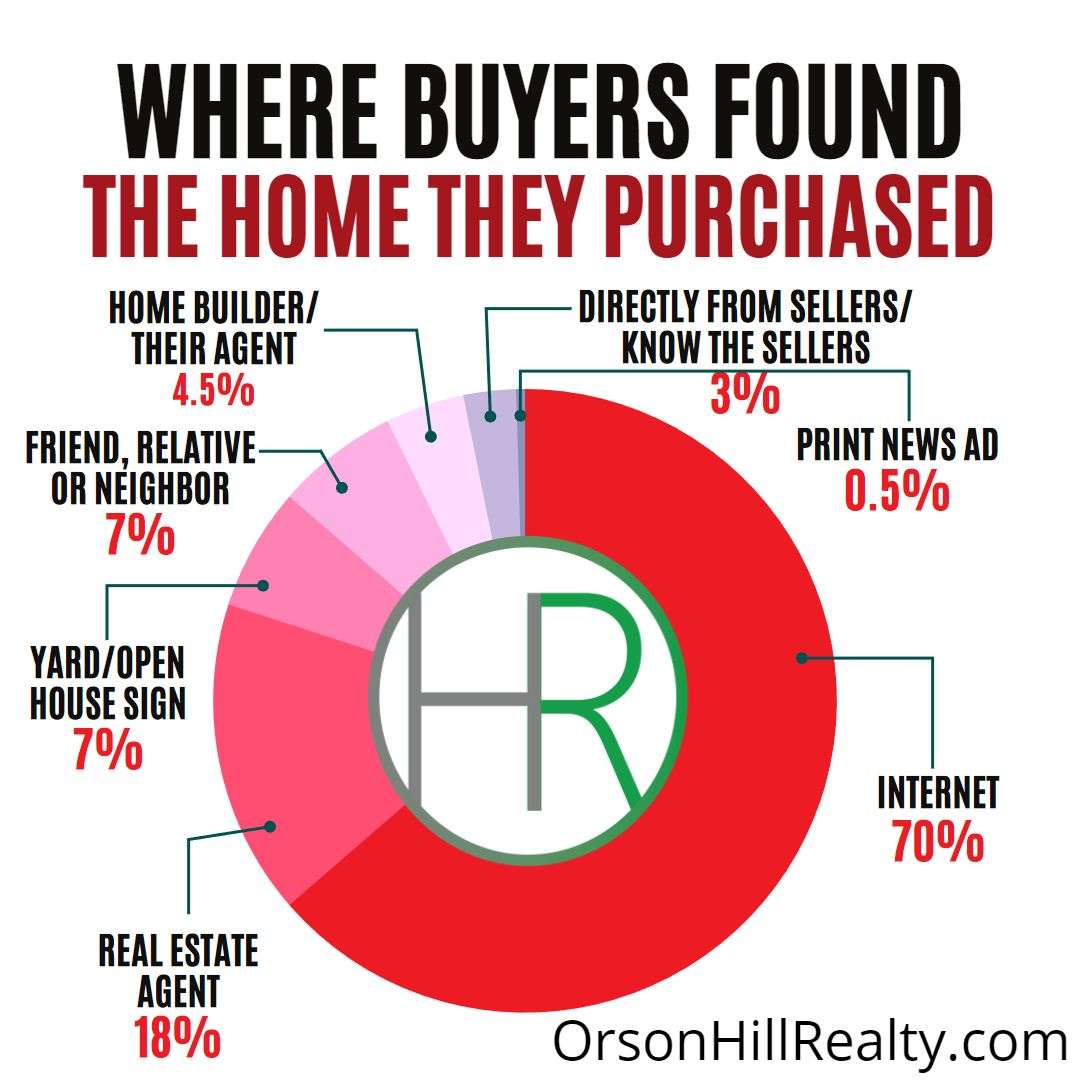

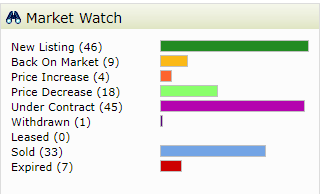

House Hunting: This is where you start visiting homes in person. It’s important to take your time and consider all aspects of the homes you view, including their location, condition, size, and layout.

Make an Offer: Once you’ve found a home you love, you’ll make an offer to buy it. This is often a negotiation process, as you and the seller may go back and forth until you agree on a price.

Home Inspection and Appraisal: After your offer is accepted, you’ll typically have a home inspection to check for potential issues with the property. Your lender will also order an appraisal to ensure the home is worth the price you’re paying.

Closing the Deal: If everything goes well with the inspection and appraisal, you’ll move forward to closing. This is when you’ll sign all the necessary paperwork, pay your down payment and closing costs, and receive the keys to your new home.

Remember, every home buying experience is unique and can vary based on factors such as the local real estate market and your personal circumstances. It’s important to do your research and consult with professionals such as a real estate agent and mortgage lender to guide you through the process.