As we move into 2023, many potential homebuyers are concerned about rising mortgage rates. After falling during the winter months, rates have started to increase in recent weeks, making some properties less affordable. If you’re thinking of buying a home this year, you may be wondering whether now is the right time to proceed or if you should wait for rates to fall again.

Inflation is Driving Rates

The recent rise in mortgage rates has been driven by inflation concerns. According to Joel Kan, Vice President and Deputy Chief Economist at the Mortgage Bankers Association (MBA), rates have increased due to market expectations that inflation will persist. This, in turn, requires the Federal Reserve to keep monetary policy restrictive for a longer time.

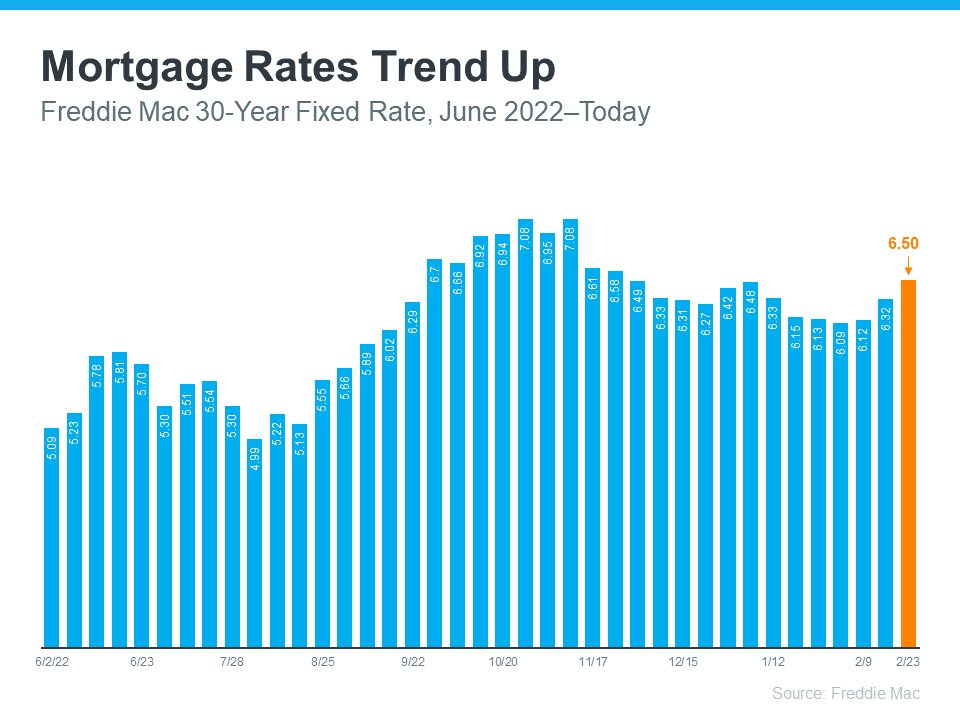

The latest weekly average 30-year fixed mortgage rate reported by Freddie Mac is 6.5%, putting them at the highest point they’ve been this year. This marks the third week in a row that rates have risen.

Don’t Delay Buying a Home

If you’re considering delaying your home search because of the increasing rates, you may want to reconsider. This could actually be an opportunity to purchase the home you’ve been searching for. The MBA reports that mortgage applications have declined by 13.3% in just one week, indicating that the rise in mortgage rates is causing some potential homebuyers to put their search on hold.

However, if you choose to stay the course, you’ll likely face less competition among other buyers when you’re looking for a home. This is a welcome relief in a market that has so few homes for sale.

Find People You Can Trust

The bottom line is that despite the recent rise in mortgage rates, you shouldn’t delay your plans to buy a home. In fact, it could mean the opposite if you want to take advantage of less buyer competition. If you’re interested in exploring the options in your local market, it’s a good idea to connect with a trusted real estate agent and a trusted mortgage lender to be part of your “home buying team”.

Leave A Comment

You must be logged in to post a comment.