2024 is the Revival of the Housing Market… AGAIN

The recent period of stagnation in the housing market is giving way to signs of a robust revival, characterized by notable improvements in key areas. This resurgence is driven by a combination of factors, including a significant reduction in mortgage rates, an increase in the availability of homes, and a renewed enthusiasm among buyers. These developments are reshaping the landscape of the housing market, suggesting a promising shift towards growth and stability.

Decline in Mortgage Rates Fuels Market Recovery

A pivotal factor in the market’s recovery has been the decline in mortgage rates from highs above 7% to the mid-6% range in December. This decrease has reignited interest in home buying, as evidenced by a 34% increase in mortgage applications for the week ending January 19, compared to four weeks earlier, according to the Mortgage Bankers Association. The lowering of rates has made home ownership more attainable, leading to a surge in both new-home sales and pending home sales, with increases of 8% and 8.3% respectively from November to December, as reported by the U.S. Census Bureau, the U.S. Department of Housing and Urban Development, and the National Association of Realtors®.

Cautious Optimism in the Market’s Direction

Despite these positive signs, experts like Danielle Hale, Chief Economist at Realtor.com®, urge caution, suggesting that it may be too early to declare a full-scale recovery. The market for resale homes, in particular, has shown mixed results, with a slight decrease in sales of existing homes. This indicates the market’s ongoing fluctuations and the impact of seasonal trends.

Mortgage Rates: The Driving Force Behind Market Dynamics

The recent improvement in the housing market is largely attributed to the reduction in mortgage rates, making monthly payments more affordable and thereby increasing the appeal of home ownership. However, economists, including Charlie Dougherty of Wells Fargo, anticipate that mortgage rates will remain above 6% and volatile throughout the year, despite potential Federal Reserve rate cuts.

Increasing Inventory Marks a Turning Point

A significant development in the market’s recovery is the increase in homes for sale, addressing the critical shortage of inventory. Recent data from Realtor.com® shows an 8.6% rise in active listings, indicating that more homeowners are now inclined to sell. Additionally, the National Association of Home Builders forecasts a 5.5% increase in single-family home construction, signaling a positive trend towards market stabilization.

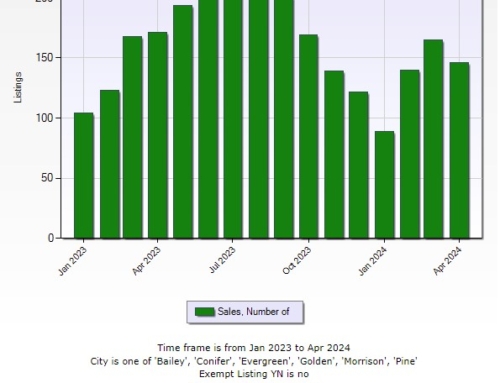

Home Sales Rebound: A Sign of Market Resilience

After a downturn in sales during the pandemic, the market is witnessing a rebound, suggesting that the worst may be over. This resurgence is characterized by an increase in property listings and heightened buyer interest, as market participants adjust to the new normal of higher interest rates.

The Path to Affordability and Market Stability

Despite the optimistic trends, affordability remains a significant challenge for many prospective buyers. The interplay of lower mortgage rates, increased construction, and shifting market sentiment is laying the groundwork for recovery, yet the journey towards broad-based affordability is complex and multifaceted.

Impact of Lower Mortgage Rates on the Housing Market

Lower mortgage rates reduce the cost of borrowing, making home purchases more affordable for buyers. This leads to an uptick in market activity, as more buyers are encouraged to enter the market, and homeowners consider listing their properties. The increased demand and supply dynamics can stimulate the housing market, contributing to its overall health and vitality.

Orson Hill Realty is a real estate company in Evergreen, Colorado that serves the Denver Foothills and the Denver Metro. Orson Hill Realty can assist in any size real estate transaction from small land listings to luxury listing agents and buyer brokers.

Orson Hill Realty has experienced listings agents and buyer agents. Our Realtors know how use high tech digital marketing mixed with old school marketing to sell your home faster and for more money.

This technology also helps buyers find their home faster. That way a buyer never misses the perfect home again. Any real estate agent in this day and age that doesn’t leverage technology is not doing their clients any favors. All Orson Hill Realty real estate agents are Realtors.

Orson Hill Realty is a full-service Colorado-based real estate company that offers professional real estate agents and brokers to assist you in your buying or selling process. Our agents are well-versed in the local community and have a strong online presence, making them highly effective in their field. For buyers, we offer online listing alerts and a user-friendly portal to facilitate an efficient home search, with access to homes not yet on the market, and for sellers, we advertise on a wide range of listing websites to ensure high visibility for your listing.

As realtors, we are dedicated to upholding a higher level of ethics and experience in our business, and we are deeply invested in the community, with active participation in various local events and activities. Our real estate agents possess a wealth of knowledge on the local area and know how to negotiate the best prices for your needs. We offer excellent services for luxury homes and horse properties, although we handle any size real estate transaction with utmost professionalism.

Our company places a strong emphasis on technology, recognizing the importance of an online presence to meet the demands of our fast-paced industry. With multiple high traffic websites and digital marketing strategies, we ensure that your property is marketed throughout the internet to reach a wider audience. We are dedicated to providing luxury services to all our clients, regardless of the price point.

Orson Hill Realty

Ask me about Southwest Florida real estate

Leave A Comment

You must be logged in to post a comment.