Buying a Home

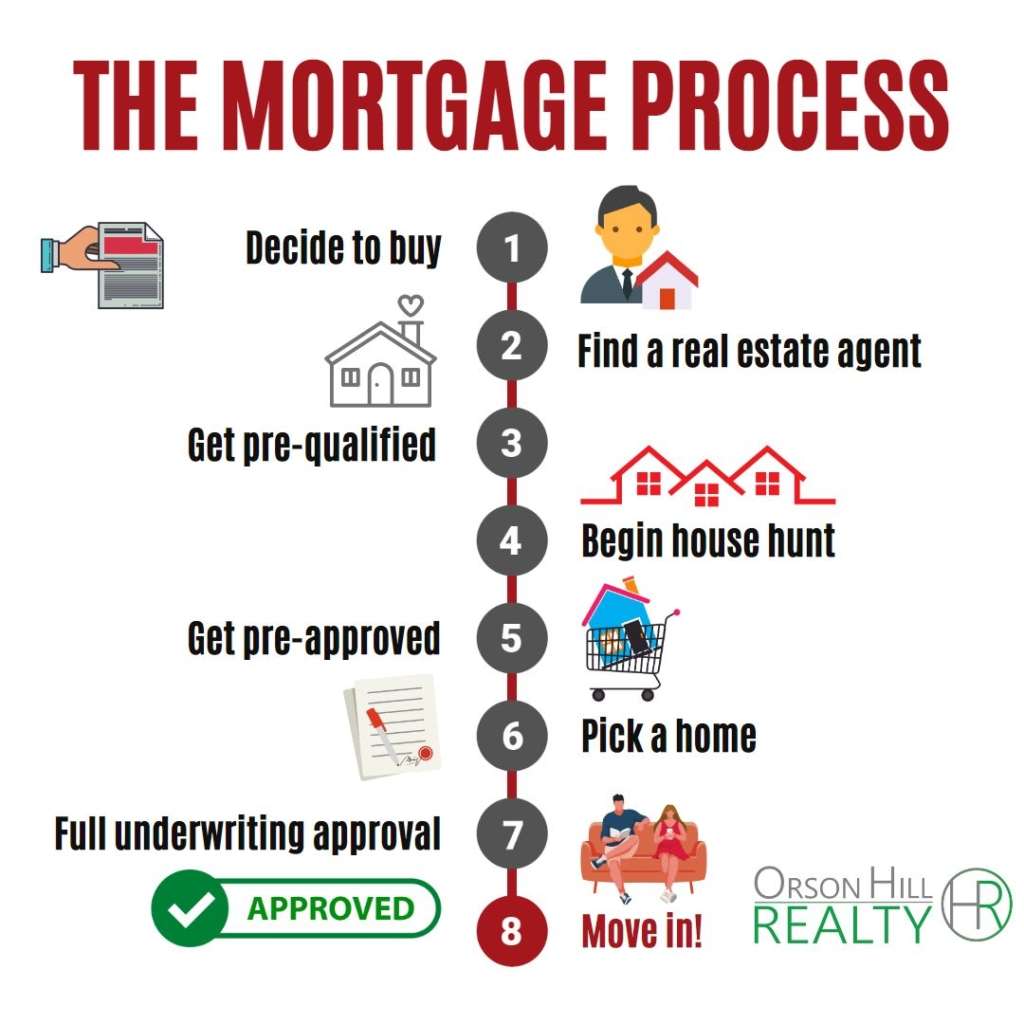

The process of buying a home can be an exciting and rewarding experience, but may also seem daunting and overwhelming, especially when it comes to the mortgage process. Fortunately, with careful preparation and understanding of the steps involved, it is possible to navigate the mortgage process with ease.

Why Buy a Home

The first step in buying a home is to decide whether owning a home is the right choice for you at this time. Owning a home comes with numerous advantages and benefits over renting, including the possibility of building equity, tax benefits, and the freedom to make changes to your home as you please. However, homeownership also comes with significant responsibilities, such as mortgage payments, property maintenance, and repairs.

Find a Real Estate Agent at Orson Hill Realty

Once you have decided to embark on the purchasing journey, it is time to find a real estate agent. A good agent can help you navigate the local housing market, offer insights into homes that may meet your needs, and guide you through the negotiating process. Be sure to do your research and find an agent who is knowledgeable, experienced, and aligns with your buying goals.

Get Pre Approved for a Mortgage

Next, it is crucial to get pre-qualified for a mortgage. This process involves reviewing your financial situation to determine how much money a lender may be willing to lend you. A pre-qualification letter is not a guarantee of a loan, but rather an estimate based on the information provided. The more accurate and complete the information provided, the more accurate the pre-qualification letter.

Getting pre-approved for a mortgage is the next step in the process. This involves submitting an application to the lender, which will review your credit history, income, and debt to determine how much they may be willing to lend you. A pre-approval letter carries more weight than a pre-qualification letter, as it shows sellers that you are a serious buyer who is likely to obtain financing.

Start House Shopping

Once you have received pre approval, it is time to begin the house hunt. With your real estate agent, you can begin touring homes that fit your budget and needs. Be sure to take your time and carefully consider each property, as obtaining financing for a mortgage is a big commitment.

Make an Offer

When you have found a home you love and want to pursue, it is time to make an offer. Your real estate agent can guide you through the negotiation process, and you may need to make concessions to the seller or offer contingencies, such as inspections or repair requirements, as part of the offer.

Full Mortage Approval

At this point in the mortgage process, you will receive full underwriting approval, which involves a thorough review of your financial situation and credit history, as well as an appraisal of the property to ensure it meets lending standards. This step is critical and involves submitting documentation and working closely with your lender to ensure that all requirements are met.

Closing Day

If your offer is accepted, it is time to finalize the mortgage and close on the property. This process involves signing a multitude of documents and working with your lender to ensure that all requirements are met. After closing, you will obtain the keys to your new home and can begin the exciting process of moving in.

Make Sure You Find a Real Estate Agent to Help You a Mortgage Person that Can Make the CLosing Happen

The mortgage process can be complex and time-consuming, but with proper preparation and understanding, it is possible to navigate it with ease. Be sure to work closely with your real estate agent and lender, and carefully consider each step of the process to ensure that you are making the best decisions for your financial future. Homeownership is an exciting journey, and with the right approach, it can be a rewarding one too.

Orson Hill Realty is a real estate company in Evergreen, Colorado that serves the Denver Foothills and the Denver Metro. Orson Hill Realty can assist in any size real estate transaction from small land listings to luxury listing agents and buyer brokers.

Orson Hill Realty has experienced listings agents and buyer agents. Our Realtors know how use high tech digital marketing mixed with old school marketing to sell your home faster and for more money.

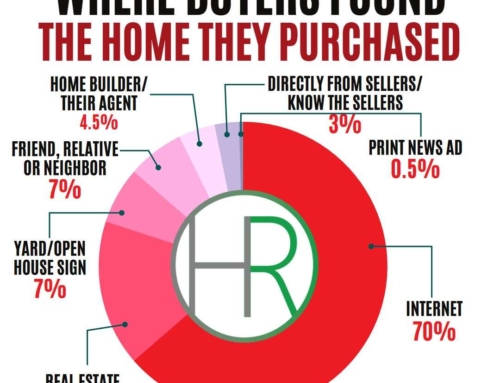

This technology also helps buyers find their home faster. That way a buyer never misses the perfect home again. Any real estate agent in this day and age that doesn’t leverage technology is not doing their clients any favors. All Orson Hill Realty real estate agents are Realtors.

Orson Hill Realty is a full-service Colorado-based real estate company that offers professional real estate agents and brokers to assist you in your buying or selling process. Our agents are well-versed in the local community and have a strong online presence, making them highly effective in their field. For buyers, we offer online listing alerts and a user-friendly portal to facilitate an efficient home search, with access to homes not yet on the market, and for sellers, we advertise on a wide range of listing websites to ensure high visibility for your listing.

As realtors, we are dedicated to upholding a higher level of ethics and experience in our business, and we are deeply invested in the community, with active participation in various local events and activities. Our real estate agents possess a wealth of knowledge on the local area and know how to negotiate the best prices for your needs. We offer excellent services for luxury homes and horse properties, although we handle any size real estate transaction with utmost professionalism.

Our company places a strong emphasis on technology, recognizing the importance of an online presence to meet the demands of our fast-paced industry. With multiple high traffic websites and digital marketing strategies, we ensure that your property is marketed throughout the internet to reach a wider audience. We are dedicated to providing luxury services to all our clients, regardless of the price point.

Orson Hill Realty

Ask me about Southwest Florida real estate

Leave A Comment

You must be logged in to post a comment.