Contest your 2023 Jefferson County Property Taxes: Understanding Jefferson County Property Tax Assessment: Exploring Options and Seeking Relief

Contesting/Disputing Your Jefferson County Taxes:

Jefferson County has just set out its 2023 property value assessments for property taxes. No one is happy. Orson Hill Realy likes to make people happy. We will be more than happy to help you contest your Jefferson County 2023 Property Taxes. Just give me a call at 303-503-8793.

(we provide this service for free. We just ask if you have a friend selling or buying a home, send them our way)

Once I send you your CMA to send to the county you will complete this form on the county website: https://www.jeffco.us/4593/20232024-Property-Valuation

What is Going on With Jefferson County’s Tax Assessor in 2023?

Recently, many homeowners in Jefferson County received a letter from the Assessor’s Office containing their updated property valuations. These valuations play a crucial role in determining the amount of property taxes individuals owe. However, numerous homeowners have been taken aback by the significant increase in their property taxes since the last reassessment two years ago, with the average rise being around 40%. This article aims to provide homeowners with valuable information regarding Jefferson County property tax assessments, explore their options, and shed light on potential relief measures.

A Guide to Appealing Real Property Valuation in Jefferson County

Jefferson County 2023 Property Valuations

Every year, on May 1, the Assessor’s Office sends a notice of valuation to real property owners in Jefferson County. However, if you believe that your property has been incorrectly valued, classified, or unfairly assessed in comparison to similar properties, you have the right to appeal. This article will provide you with essential information on the appeals process and guide you through the steps to challenge the assessment and seek a fair valuation.

I. Understanding the Appeal Timeline:

a. Filing Period: The appeal period begins on May 1 and extends through June 8. It is crucial to file your appeal early in May to avoid potential delays during the busy final days of the appeal period.

b. Deadline: All mailed appeals must be postmarked no later than June 8, 2023.

II. How to Appeal an Assessment:

a. Explaining Inaccuracies: When filing an appeal, it is important to clearly state why you believe the Assessor’s valuation is incorrect. Provide relevant information and supporting evidence to substantiate your estimate of value. The Assessor’s website contains a list of sales used to determine the current year’s actual value. By comparing your property to similar sold properties, you can determine if a fair valuation has been applied.

b. Property Records Search: Utilize the Property Records Search feature on the Assessor’s website to access property and sales information. This tool provides details on residential property sales in most neighborhoods, allowing you to gather data on comparable properties.

c. Assessor Taxpayer Services: You can request a complete list of residential property sales in your neighborhood by sending a self-addressed, stamped envelope and a description of your property to the Assessor’s office. This information will assist you in identifying sold properties that are similar to yours in terms of location, age, design, and size.

d. Real Estate Information Line: For quick access to information on up to three residences, call the Real Estate Information Line at 303-271-8666. Provide the address(es), schedule number(s), or owner’s name to obtain relevant details.

III. The Assessment Process:

Familiarize yourself with the assessment methods employed by the Assessor’s Office by referring to the Assessment Process section of their website. This will provide you with a better understanding of how valuations are determined.

IV. What to Expect After Filing an Appeal:

If you file an appeal, the Assessor’s Office will send you a notice of determination by August 15 of the appeal year. This notice will inform you of any adjustments made to the assessed value and explain the process for further appeal to the county’s Board of Equalization (BOE) if you remain dissatisfied. Appeals to the BOE must be filed by September 15. The board will conclude hearings by November 1 and notify petitioners of their decision within five business days.

Should you wish to appeal a decision made by the BOE, you must do so within 30 days of the decision. The options available to you will be outlined in the board’s response.

I. The Basis of Tax Valuations:

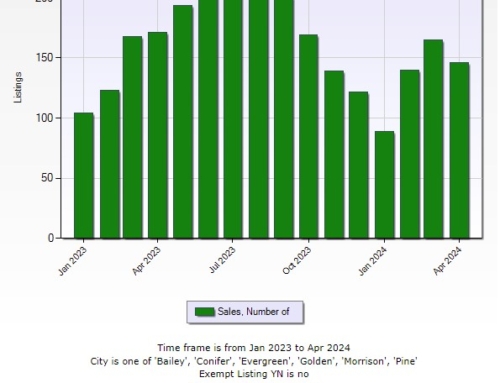

a. County Perception and Comparable Sales: The county’s perceived value of a property as of January 1, 2023, forms the foundation of tax valuations. These valuations are determined based on comparable sales within a two-year period, specifically between July 1, 2020, and June 30, 2022. Coincidentally, this period witnessed the strongest real estate growth in the Denver metro area’s history. However, it’s important to note that this period does not include the subsequent six months, during which the market experienced a slowdown due to rapid interest rate increases.

b. Rising Home Values: Since the summer of 2020, it is highly likely that your home’s value has increased substantially. In the current market, you might be surprised by the high sale price your property could command. However, this does not necessarily mean that the Assessor’s valuation of your property as of January 1, 2023, is accurate. There may be comparable sales that justify a lower valuation for tax purposes.

II. Appealing the Assessor’s Valuation:

a. Homeowner’s Right to Appeal: As a homeowner, you possess the right to appeal the Assessor’s valuation of your property. The process can be initiated by filling out a form online with your county. The deadline for filing appeals is June 8, 2023.

b. Asserting Overvaluation and Citing Specific Sales: During the appeal, you can express your belief that the Assessor’s valuation is too high. To support your case, you can cite specific sales that occurred between July 1, 2020, and June 30, 2022, which the Assessor may not have considered. By presenting these alternative sales data, you can potentially obtain a lower valuation for tax purposes.

III. Legislative Relief Measures:

a. Pending Legislation: Currently, there is a bill progressing through the Colorado legislature aimed at offering homeowners relief from the rapid increase in assessed valuations. However, the specifics of this legislation are yet to be finalized. Moreover, it remains uncertain whether the bill will pass, be signed into law, and provide the anticipated relief.

Jefferson County Tax Assessor Value Your Home Too High? Orson Hill Realty Can Help

Navigating the Jefferson County property tax assessment system can be complex and overwhelming, especially in light of recent increases in property valuations. However, homeowners have options to challenge these valuations through the appeals process. Additionally, there is hope for potential relief through pending legislation in the Colorado legislature. Remember, we are here to help you understand and navigate these processes, ensuring that you make informed decisions regarding your property taxes.

Taking proactive steps to appeal your real property valuation in Jefferson County is crucial in ensuring a fair assessment. By familiarizing yourself with the process and gathering relevant information, you can present a compelling case. Remember, the appeal period is limited, so act promptly. Exercise your right to challenge an incorrect valuation and seek a fair and equitable assessment for your property

Disclaimer: I am not a CPA or Attorney. The way I provide assistance is by giving you new home values and comps to provide to the county. It is a CMA or Broker opinion of value.

I provide a free service for Jefferson COunty and Clear Creek homeowners to help them with their JEFFCO property tax burdens. I provide a CMA or BPO of their property to present to Jefferson County Assessor. All we ask in return is if you have friends or family selling or buying a home let them know we were cool to you LOL. Let us know how we can help. 303-503-8793.

Orson Hill Realty is a real estate company in Evergreen, Colorado that serves the Denver Foothills and the Denver Metro. Orson Hill Realty can assist in any size real estate transaction from small land listings to luxury listing agents and buyer brokers.

Orson Hill Realty has experienced listings agents and buyer agents. Our Realtors know how use high tech digital marketing mixed with old school marketing to sell your home faster and for more money.

This technology also helps buyers find their home faster. That way a buyer never misses the perfect home again. Any real estate agent in this day and age that doesn’t leverage technology is not doing their clients any favors. All Orson Hill Realty real estate agents are Realtors.

Orson Hill Realty is a full-service Colorado-based real estate company that offers professional real estate agents and brokers to assist you in your buying or selling process. Our agents are well-versed in the local community and have a strong online presence, making them highly effective in their field. For buyers, we offer online listing alerts and a user-friendly portal to facilitate an efficient home search, with access to homes not yet on the market, and for sellers, we advertise on a wide range of listing websites to ensure high visibility for your listing.

As realtors, we are dedicated to upholding a higher level of ethics and experience in our business, and we are deeply invested in the community, with active participation in various local events and activities. Our real estate agents possess a wealth of knowledge on the local area and know how to negotiate the best prices for your needs. We offer excellent services for luxury homes and horse properties, although we handle any size real estate transaction with utmost professionalism.

Our company places a strong emphasis on technology, recognizing the importance of an online presence to meet the demands of our fast-paced industry. With multiple high traffic websites and digital marketing strategies, we ensure that your property is marketed throughout the internet to reach a wider audience. We are dedicated to providing luxury services to all our clients, regardless of the price point.

Orson Hill Realty

Ask me about Southwest Florida real estate

Leave A Comment

You must be logged in to post a comment.