Real Estate Market Highlights Feb 2023

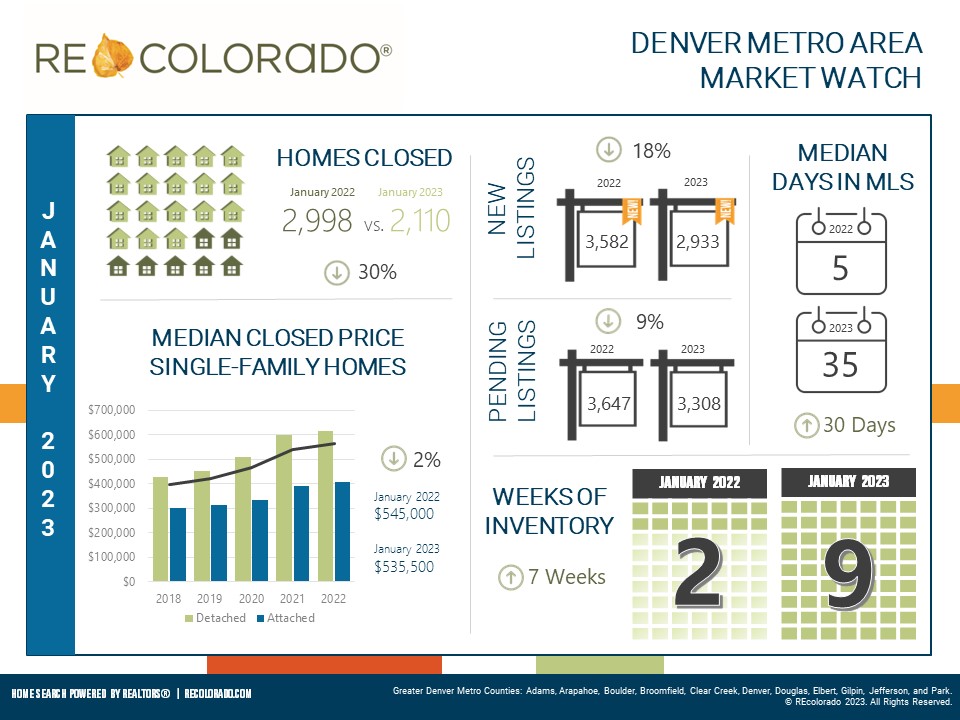

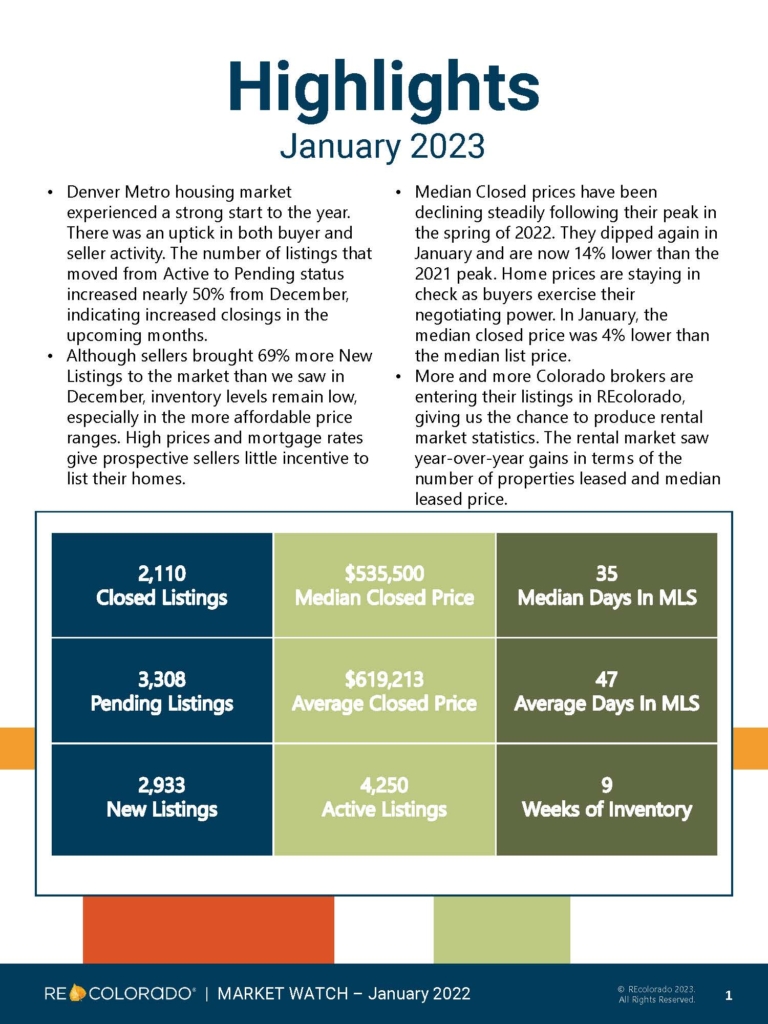

The real estate market has had a strong start to the year, with both buyer and seller activity increasing. This is reflected in the nearly 50% increase in listings moving from Active to Pending status from December to January, indicating that more closings are expected in the upcoming months.

Despite a 69% increase in new listings from sellers compared to December, inventory levels remain low, particularly in the more affordable price ranges. High prices and mortgage rates mean that prospective sellers have little motivation to list their homes.

Median closed prices have been decreasing steadily since their peak in the spring of 2022, with prices dipping again in January. The current median closed price is now 14% lower than the peak in 2021. This decline is due to buyers exercising their negotiating power, which is keeping home prices in check. In January, the median closed price was 4% lower than the median list price.

In addition, more and more Colorado brokers are entering their listings in REcolorado, allowing for the production of rental market statistics. The rental market has seen year-over-year gains, with an increase in the number of properties leased and the median leased price.

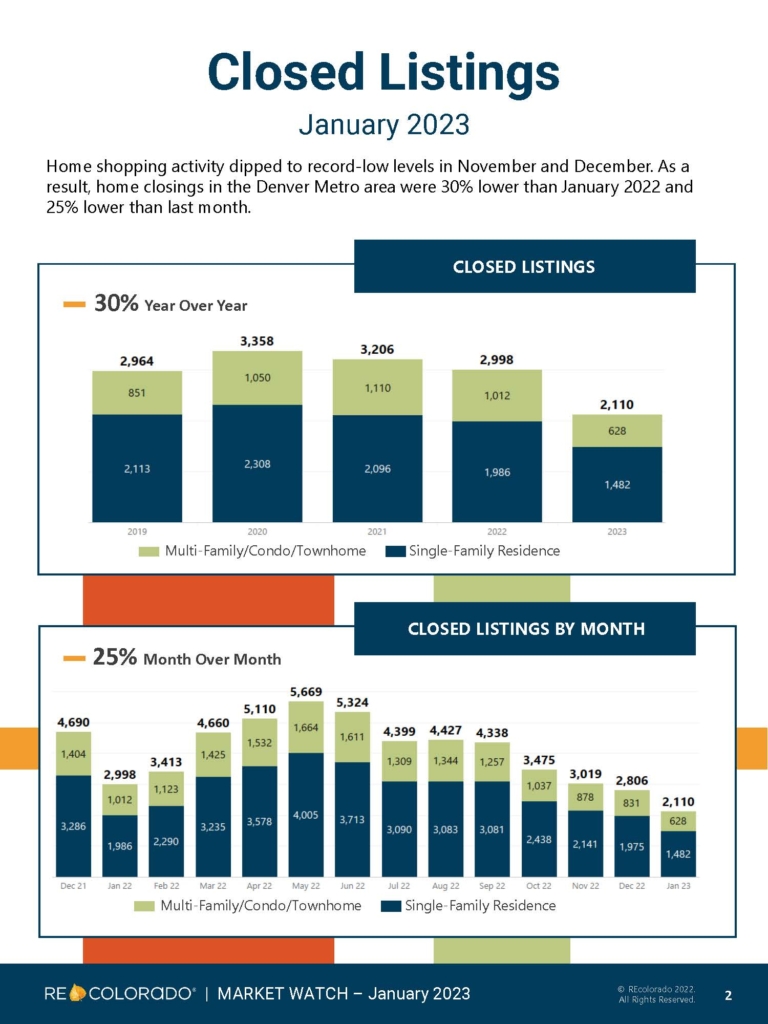

Closed Listings…

Home shopping activity in the Denver Metro area experienced a significant decline in the months of November and December, reaching record-low levels. This trend resulted in a decrease in home closings in January 2023. Compared to the same month in the previous year, home closings were down by 30%. Furthermore, home closings were 25% lower than the number of closings that occurred last month. This suggests that the lower home shopping activity in the last two months has had a noticeable effect on the number of homes being sold in the Denver Metro area.

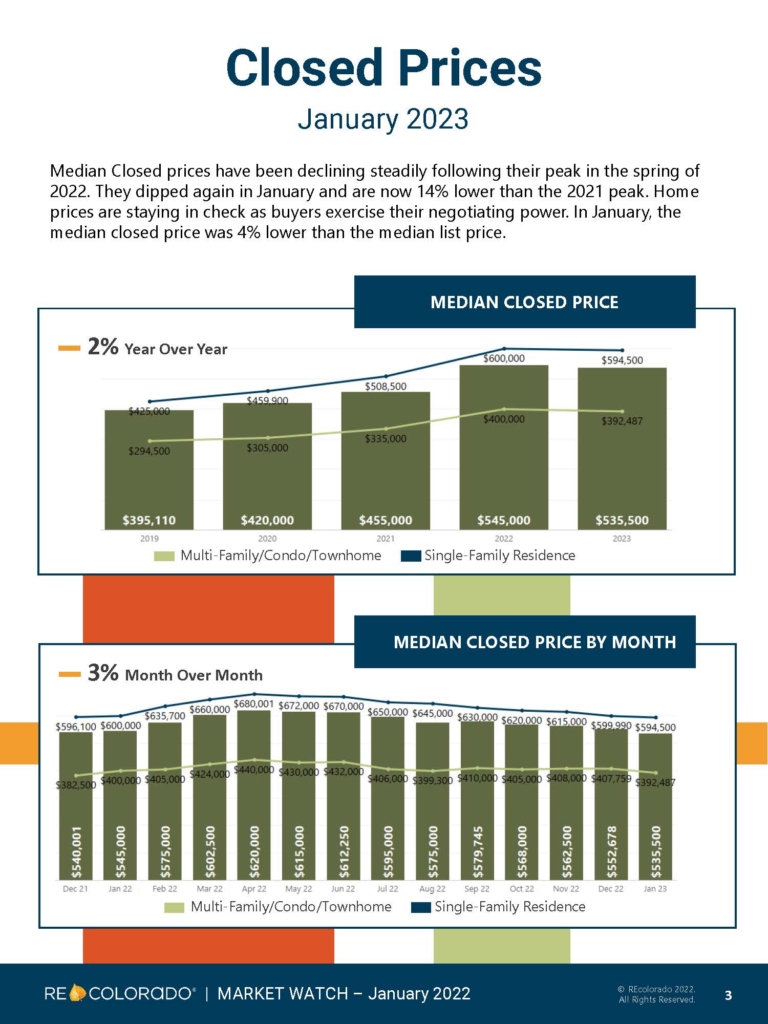

Closed Pricing….

The median closed prices of homes have been declining steadily since reaching their peak in the spring of 2022. In January of 2023, these prices once again dipped, and are currently 14% lower than the peak that was reached in 2021. This decline is a result of buyers exerting their bargaining power, which is helping to keep home prices under control.

Additionally, in January, the median closed price was 4% lower than the median list price, indicating that buyers are successful in negotiating lower prices for homes. This also suggests that the real estate market is currently favoring buyers, who have the ability to negotiate for more favorable terms in their home purchases.

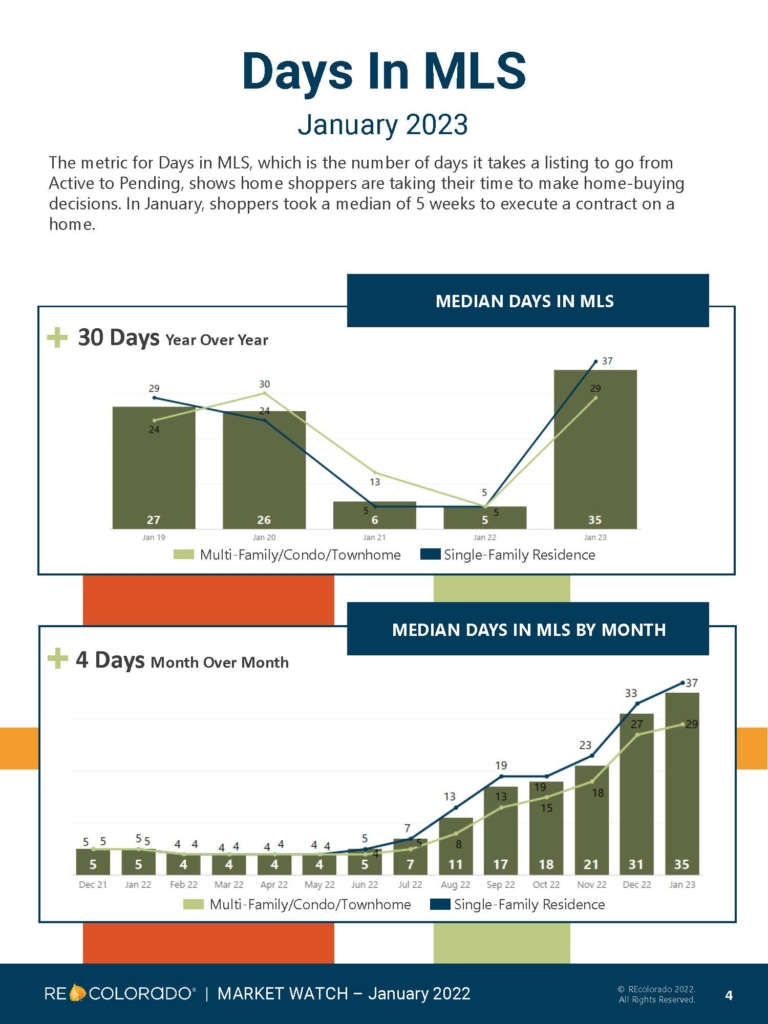

Days in The MLS

The Days in MLS metric, which measures the number of days it takes for a listing to transition from Active to Pending status, indicates that homebuyers are taking their time to make purchasing decisions. In January of 2023, the median number of weeks it took for shoppers to execute a contract on a home was 5. This suggests that homebuyers are not feeling rushed to make decisions and are taking a more measured approach to the home buying process. This could be due to a number of factors, such as the current buyer’s market, where there are more homes available than there are interested buyers. Additionally, homebuyers may be taking their time to carefully consider their options, ensuring that they find the right home that meets their needs and budget.

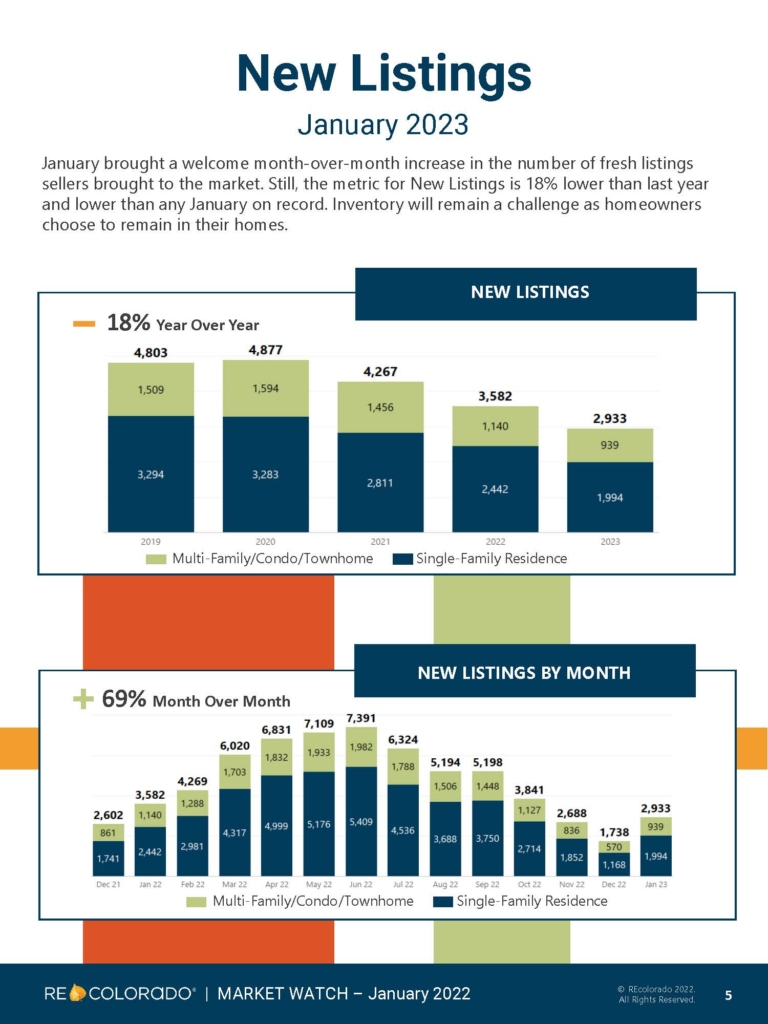

New Listings…

In January of 2023, there was a month-over-month increase in the number of new listings that sellers brought to the real estate market. This increase was a positive development, as it provided more options for potential homebuyers. However, despite this increase, the New Listings metric was still 18% lower than it was during the same period last year. In fact, it is also lower than any January on record, indicating that inventory is currently a significant challenge for the real estate market.

One reason for the low inventory is that many homeowners are choosing to remain in their current homes rather than selling them. This is likely due to several factors, including the current high home prices, which make it difficult for many homeowners to find a new property that fits their budget. Additionally, many homeowners may be reluctant to move due to the ongoing COVID-19 pandemic and related concerns about safety and health. All of these factors have contributed to a low inventory, which may continue to be a challenge for the real estate market in the near future.

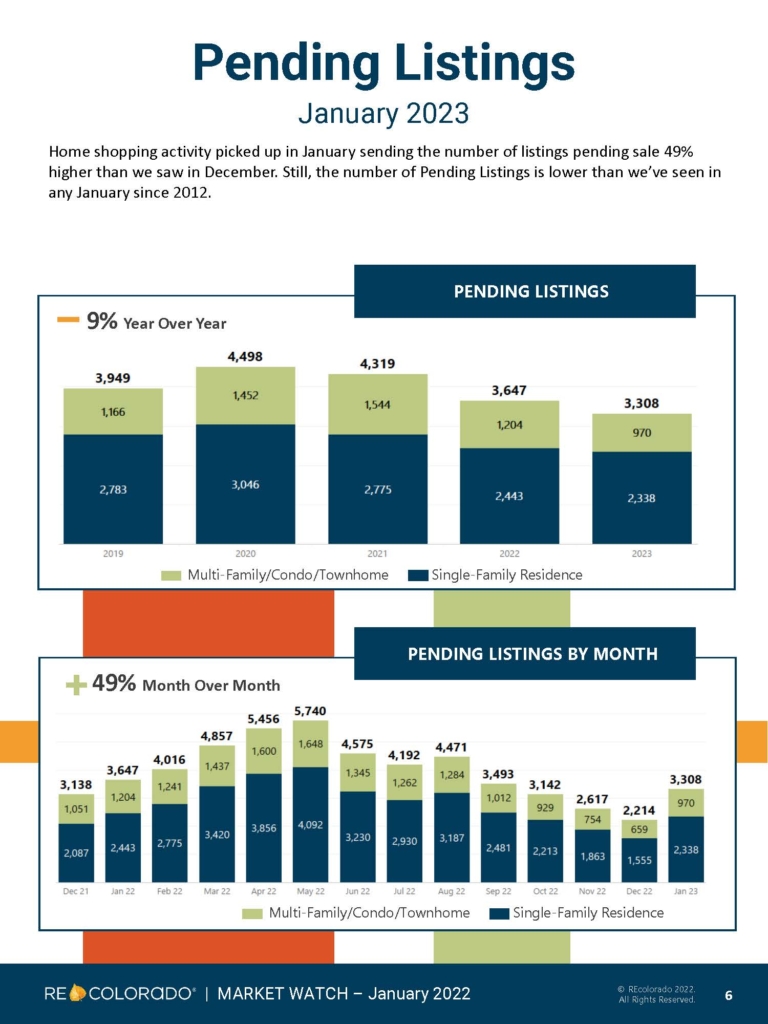

Pending Listings…

In January of 2023, there was a noticeable increase in home shopping activity, which resulted in a 49% increase in the number of listings that were pending sale, as compared to the previous month of December. This increase in home shopping activity is a positive development for the real estate market, indicating that there is renewed interest among potential buyers.

However, it is important to note that despite the increase in pending listings, the number of pending listings in January is lower than what was seen in any January since 2012. This indicates that there are still fewer homes available for sale than in previous years, which may be a result of several factors, such as high home prices, low inventory, and homeowners choosing to remain in their current homes. While the increase in home shopping activity is a good sign for the market, the low number of pending listings suggests that the overall supply of homes remains limited, which could impact the market in the coming months.

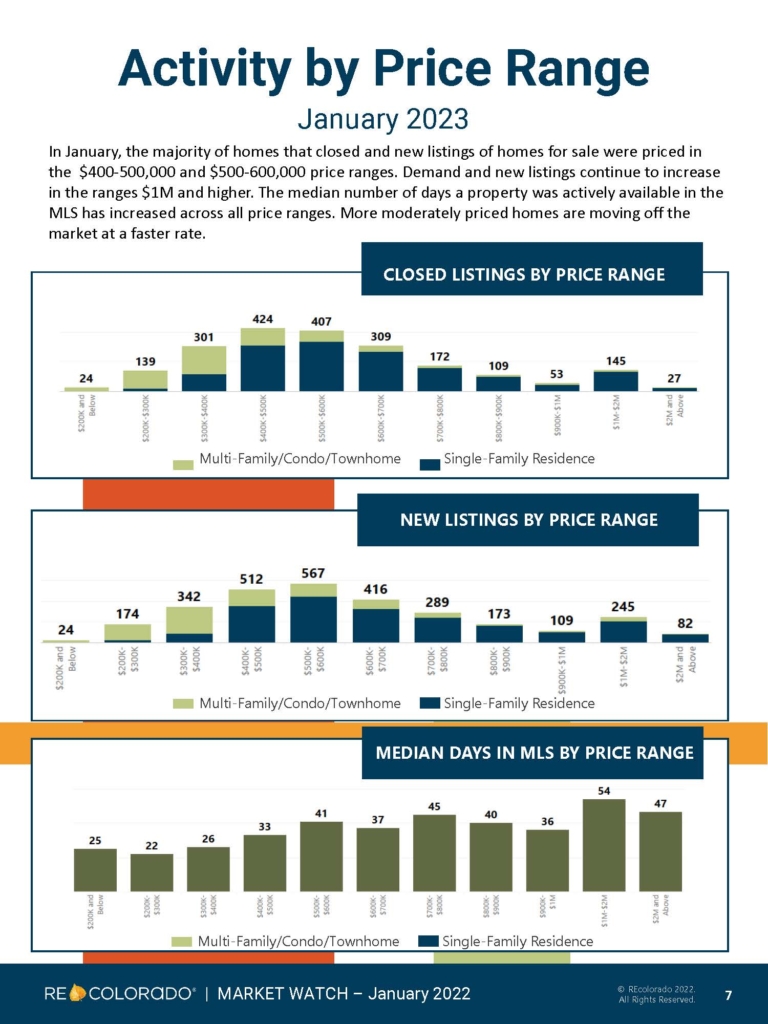

Activity By Price Point

In January of 2023, the majority of homes that both closed and became new listings for sale were priced in the $400,000 to $500,000 and $500,000 to $600,000 price ranges. This indicates that these price ranges are currently in high demand among homebuyers.

Additionally, there has been an increase in demand for homes priced at $1 million and higher. This trend suggests that there is a growing interest in luxury properties among potential buyers, possibly due to factors such as an improving economy and high-income earners looking to invest in real estate.

However, it is important to note that across all price ranges, the median number of days that a property was actively available in the MLS has increased. This means that homes are taking longer to sell than they did previously, which could be due to a variety of factors such as high prices, low inventory, and increased caution among potential buyers.

Interestingly, moderately priced homes are moving off the market at a faster rate, despite the overall trend of increasing days on the market. This could be because these homes are more affordable and thus more accessible to a larger pool of potential buyers. Overall, these trends indicate that there is still strong demand for homes in the Denver Metro area, but that buyers are being more cautious and taking longer to make purchasing decisions.

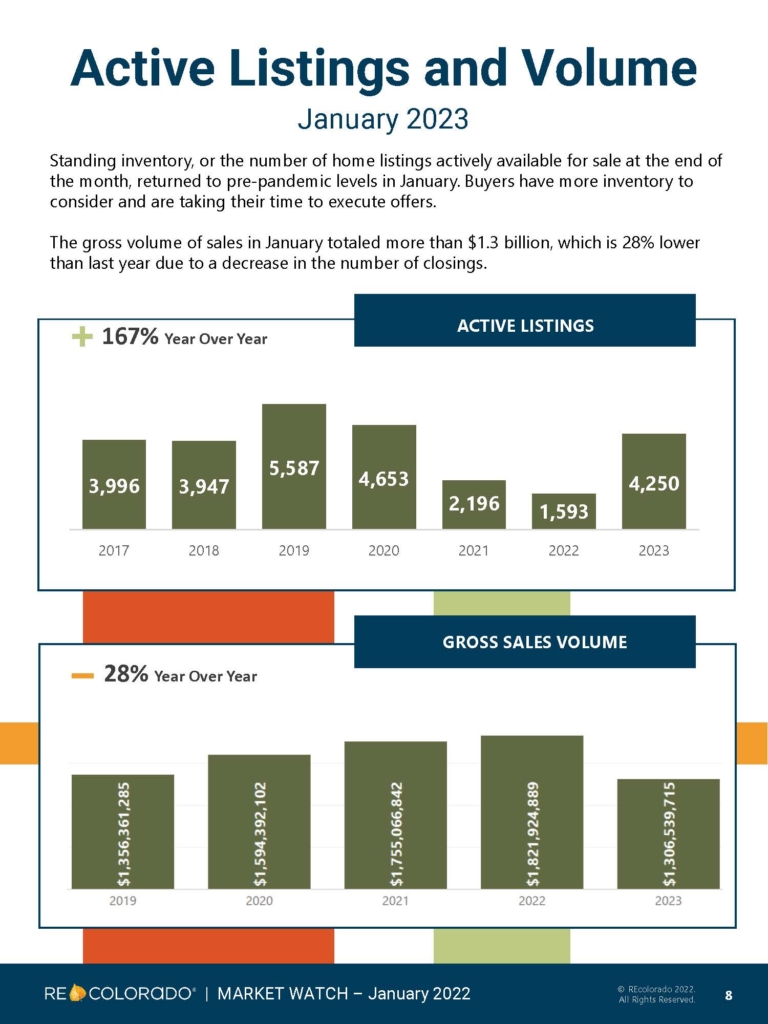

Active Listings By Volume

In January, the standing inventory of homes, defined as the number of home listings that were actively available for sale at the end of the month, returned to pre-pandemic levels. This means that buyers have a greater number of options to consider and are taking their time to make purchasing decisions.

Despite the increased inventory, the gross volume of sales in January amounted to over $1.3 billion, which is a 28% decrease compared to the previous year. This decline in sales can be attributed to a decrease in the number of closings during the period.

Glossary

The rental market statistics for January 2023 were produced from rental listings entered in the REcolorado MLS database. The data shows a year-over-year increase in the number of properties leased during the period. This indicates that demand for rental properties is on the rise.

The median leased price per square foot also increased, reflecting tenants’ willingness to pay more for suitable properties. In January 2023, the median leased price was 8 dollars per square foot, which is a 3% increase compared to the previous year.

The median days a rental property spent on the market also increased slightly, with a 9% year-over-year increase from January 2022. Meanwhile, the median leased price per bedroom increased by 1% year over year.

Overall, the rental market in January 2023 saw healthy year-over-year gains in terms of the number of properties leased and median leased prices.

Orson Hill Realty is a real estate company in Evergreen, Colorado that serves the Denver Foothills and the Denver Metro. Orson Hill Realty can assist in any size real estate transaction from small land listings to luxury listing agents and buyer brokers.

Orson Hill Realty has experienced listings agents and buyer agents. Our Realtors know how use high tech digital marketing mixed with old school marketing to sell your home faster and for more money.

This technology also helps buyers find their home faster. That way a buyer never misses the perfect home again. Any real estate agent in this day and age that doesn’t leverage technology is not doing their clients any favors. All Orson Hill Realty real estate agents are Realtors.

Orson Hill Realty is a full-service Colorado-based real estate company that offers professional real estate agents and brokers to assist you in your buying or selling process. Our agents are well-versed in the local community and have a strong online presence, making them highly effective in their field. For buyers, we offer online listing alerts and a user-friendly portal to facilitate an efficient home search, with access to homes not yet on the market, and for sellers, we advertise on a wide range of listing websites to ensure high visibility for your listing.

As realtors, we are dedicated to upholding a higher level of ethics and experience in our business, and we are deeply invested in the community, with active participation in various local events and activities. Our real estate agents possess a wealth of knowledge on the local area and know how to negotiate the best prices for your needs. We offer excellent services for luxury homes and horse properties, although we handle any size real estate transaction with utmost professionalism.

Our company places a strong emphasis on technology, recognizing the importance of an online presence to meet the demands of our fast-paced industry. With multiple high traffic websites and digital marketing strategies, we ensure that your property is marketed throughout the internet to reach a wider audience. We are dedicated to providing luxury services to all our clients, regardless of the price point.

Orson Hill Realty

Ask me about Southwest Florida real estate

Leave A Comment

You must be logged in to post a comment.